Jerry Jones is a man of many talents. From his gridiron glory to his boardroom brilliance, Jones has left an indelible mark on the American landscape. But while his NFL exploits might steal the show, there’s another side to his business empire that often gets overshadowed: his savvy investments in the energy sector, particularly natural gas.

Born in the City of Angels, Jerry Jones grew up surrounded by the hustle and bustle of entrepreneurship. His dad, J.W. “Pat” Jones, ran a thriving grocery store chain in North Little Rock, Arkansas. Growing up in that kind of environment, it’s no surprise Jones soaked up the entrepreneurial spirit like a sponge. It’s like he was born with a business plan in his DNA!

Jones’s early foray began with a splash of pizzazz, with his first venture being a chain of Shakey’s Pizza parlors, which turned out to be a flop. Talk about a pizza party that went wrong! Undeterred, Jones kept his entrepreneurial spirit burning and eventually found his footing.

Back in the groovy 70s, Jerry Jones struck oil—literally! He founded Jones Oil and Land Lease, a private company that was basically his ticket to riches. With a mix of savvy investments and calculated risks, Jones built a thriving business that lined his pockets with a significant fortune. Talk about striking it rich!

“There are a lot of people with money, but not with the passion to really go spend it.” — Jerry Jones

The man with a nose for a good deal made a risky play in the 1980s by snatching up oil and gas leases in the Arkoma Basin. Amidst the skepticism of industry experts, Jones, the eternal optimist, saw something others couldn’t. Turns out, he was right. When he flipped those leases to Arkla Inc. a few years later, he walked away with a fat wad of cash, proving once again that sometimes the biggest risks can lead to the biggest rewards.

While Jones’s oil and gas ventures were thriving, his passion for football remained unwavering. In 1989, he took a gamble and plunked down a cool $140 million for the Dallas Cowboys, a team that was as broke as a joke. It was a risky move, but Jones, being the risk-taker he is, saw potential where others saw only despair.

With a deft touch, the master of corporate resuscitation breathed new life into the floundering Cowboys. He axed the legendary coach Tom Landry, a move that sent shockwaves through the NFL. But Jones’s gamble paid off. He brought in a new management team and breathed fresh life into the franchise. Under his leadership, the Cowboys transformed from a floundering team to a dominant force, clinching three Super Bowl titles in the 1990s.

While the Cowboys were raking in Super Bowl victories, Jerry Jones wasn’t content to rest on his laurels. He had his sights set on another empire: natural gas. In 2018, he made a gutsy move by buying up Comstock Resources, a gas company that was basically drowning in debt. It was a move that raised eyebrows and had many scratching their heads, but Jones, ever the maverick, saw an opportunity where others saw only despair.

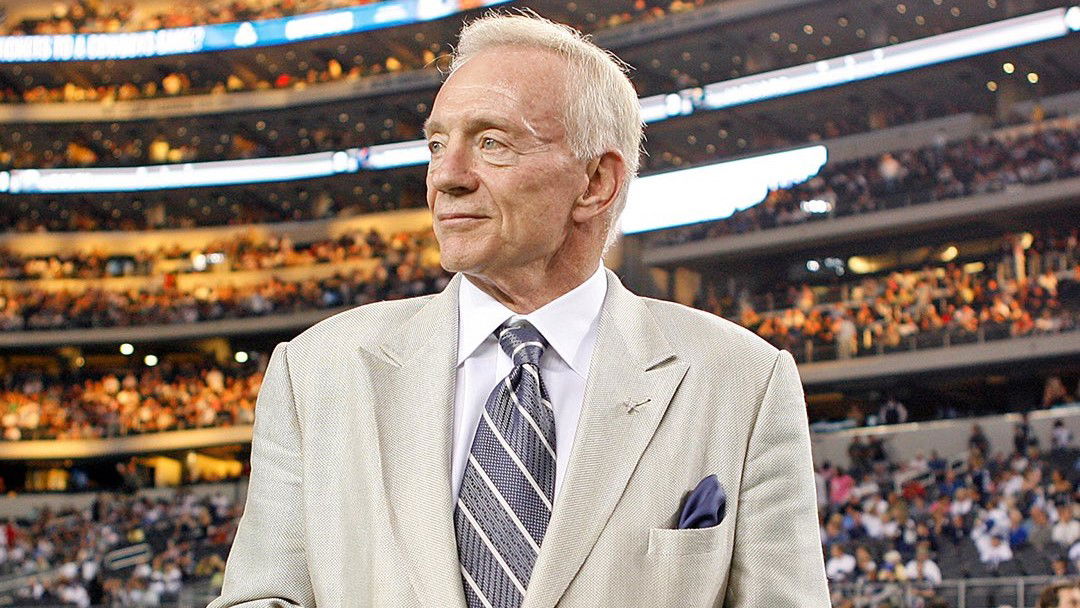

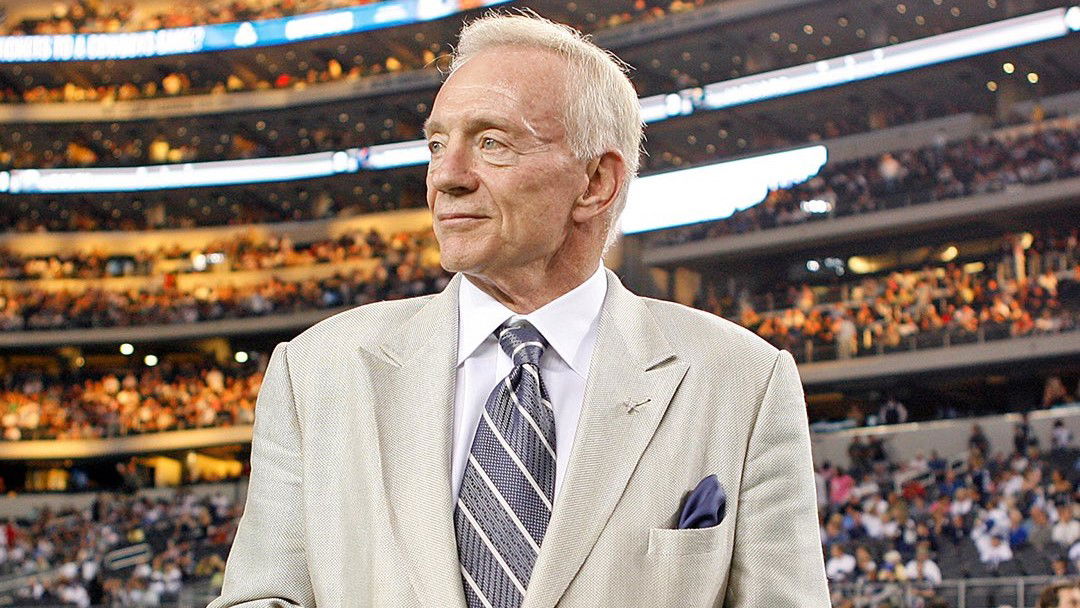

Imago

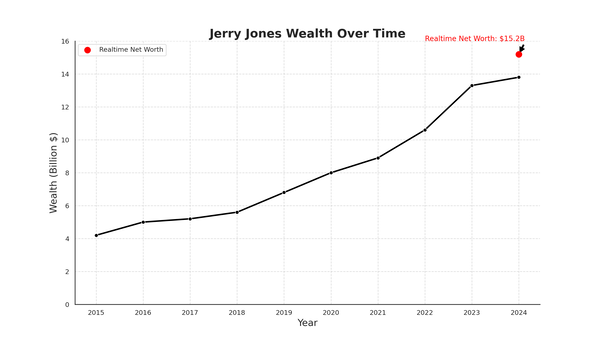

A decade-long analysis of the Dallas Cowboys owner’s wealth, showcasing his net worth growth from $4.2 billion in 2015 to $15.2 billion in real-time (according to Forbes).

But Jones didn’t just believe in natural gas; he believed in natural gas. He had faith in its potential, even when everyone else was counting it out. And boy, did that faith pay off big time! As the world started craving more and more LNG, Comstock Resources skyrocketed. Jones’s smart moves and leadership turned the company into a natural gas powerhouse.

Jones’s success in the energy sector can be attributed to several key factors. Decades of experience in the oil and gas industry have honed his instincts. He can spot a goldmine in a pile of rocks. And he’s not afraid to roll the dice, to take a gamble on a risky venture. He’s a calculated risk-taker, a man who’s not afraid to go against the grain.

Jones saw the big picture. He knew that the Haynesville Basin was a goldmine just waiting to be tapped. It was a risky bet, but Jones, being the maverick he is, wasn’t afraid to take the plunge. By investing in Comstock Resources and acquiring assets in the Haynesville Basin, he positioned himself to ride the wave of the growing demand for LNG.

“He made one of the biggest out-of-consensus bets. It’s almost like when he bought the Dallas Cowboys… It looks like an easy bet now, but at the time, everybody shook their head. I couldn’t find another investor out there that was positive on natural gas.” Neal Dingmann, Managing Director of Truist Securities

This was just one example of Jones’s ability to spot potential and take calculated risks. He’s also diversified his portfolio across energy, technology, real estate, and even sports franchises. And while he’s not afraid to take a gamble, he’s also got a long-term perspective. He holds onto investments for years, even decades, allowing them to grow over time.

Jones is also known for his hands-on approach. He’s not just a passive investor. He’s actively involved in the companies he invests in, helping to guide their strategic direction. And with his deep knowledge of the oil and gas industry, he’s able to make informed decisions about where to invest.

Perhaps the most valuable lesson we can learn from Jerry Jones is the importance of thinking outside the box. He’s not afraid to explore unconventional investments, and it’s that willingness to take risks that has helped him build his massive fortune.

Imago

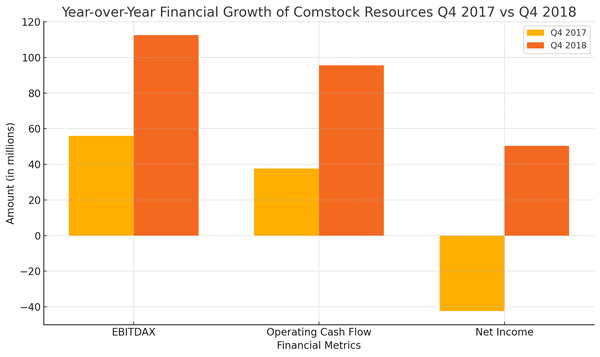

The year-over-year financial growth of Comstock Resources from Q4 2017 to Q4 2018 (highlighting the significant improvements in EBITDAX, operating cash flow, and net income after Jerry Jones rolled his assets into the company)

Now, imagine being able to invest in the same oil and gas wells that the billionaire owner of the Dallas Cowboys, Jerry Jones, is backing. Sounds like a dream, right? Well, thanks to StrongHeart Energy, it’s now a reality. And the best part is, you don’t need to be a billionaire to get involved.

StrongHeart Energy, a leading financial platform, offers a unique opportunity for individuals to invest in the same high-quality energy projects that attract the likes of Jones. By leveraging its extensive industry connections and rigorous due diligence, StrongHeart provides access to exclusive opportunities to invest in the exact oil wells that the biggest oil companies in the world are drilling—deals that would otherwise be unavailable to individual investors. But that’s not all.

One of the most appealing aspects of investing in oil and gas in the United States, outside of the tremendous returns, is the significant tax advantages offered. StrongHeart’s platform allows investors to capitalize on these benefits, including deductions for intangible drilling costs and depletion allowances, which can significantly reduce taxable income. Yes, these tax breaks can make a huge difference in your bottom line, but they’re just one part of the equation.

By partnering with StrongHeart Energy, investors gain access to a diverse range of investment opportunities, with packages that include new drills operated by titans in the oil and gas industry, as well as proven, developed, producing (PDP) wells and assets in highly coveted oil and gas basins across the United States. These basins, such as the Permian Basin, DJ Basin, Powder River Basin, and Williston Basin, offer promising returns and growth potential. And with StrongHeart’s expertise and network, you can be confident that you’re investing in high-quality projects with a proven track record.

StrongHeart Energy’s expertise and network enable them to identify deals that offer healthy returns, minimal risk, and incredible tax benefits. Their target returns include an 85% tax deduction of investment, an 80% target ROI, and a 40% IRR, tax advantaged. But what makes StrongHeart truly stand out is their commitment to making energy investments accessible to everyone.

Jerry Jones has a keen eye for investment opportunities, especially in the energy sector. He’s poured billions into oil and gas exploration, recognizing the potential for significant returns. StrongHeart Energy, on the other hand, is making it easier than ever for everyday investors to get a piece of the action in the U.S. energy market.

With its user-friendly platform and expert guidance, StrongHeart is democratising access to energy investments. It connects you with top-tier drillers and operators, giving you access to exclusive deals that aren’t available through traditional channels. It’s like having a direct line to the energy industry’s big players while being offered a range of benefits that make the platform even more attractive.

< Disclaimer: This article features Jerry Jones for illustrative purposes only. He is not affiliated with, nor does he endorse, StrongHeart Energy or its investment offerings. The reference to Mr. Jones serves to highlight the growing interest of high-profile individuals in the energy sector.>

StrongHeart offers a range of benefits that make its platform even more attractive. For starters, investing in oil and gas in the United States comes with significant tax advantages. You can deduct intangible drilling costs and depletion allowances, potentially reducing your taxable income by up to 85%. They protect their investing partners against any risk of dry holes in their “Dry Hole Protection Program.” And if you’re concerned about ESG factors, StrongHeart has you covered. They integrate Environmental Stewardship, Social Responsibility, and Corporate Governance principles into their everyday operations.

So, if you’re looking to follow in the footsteps of the energy industry tycoons and invest in the energy sector, StrongHeart Energy is the perfect partner. With their expertise, their platform, and their commitment to making energy investments accessible to everyone, you can be confident that you’re making a smart and sustainable investment. After all, the global demand for natural gas, oil, and other energy resources will continue to rise. By partnering with StrongHeart Energy, you can position yourself to benefit from the growing energy landscape—just like Jerry Jones did!

This article is a custom editorial piece created in partnership with StrongHeart Energy. While it highlights the investment opportunities within the energy sector, it is intended for informational purposes only and does not constitute financial advice. As with any investment, there are significant risks involved. Readers are encouraged to conduct thorough research and consult with financial and legal advisors before making any investment decisions