via Imago

Credits: Imago

via Imago

Credits: Imago

The Super Bowl-sized tax losses claimed by professional sports team owners have caught the Internal Revenue Service’s attention, calling for increased audit scrutiny. An audio-video clip of Alex Mena, who runs criminal investigations at the IRS, was leaked on X. Published by notorious sting operator journalist James O’Keefe, this recording hints at the IRS potentially targeting NFL team owners.

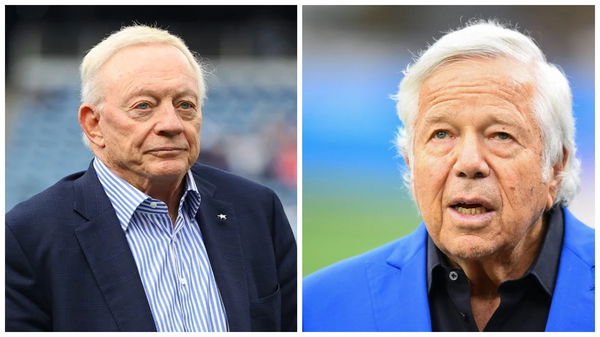

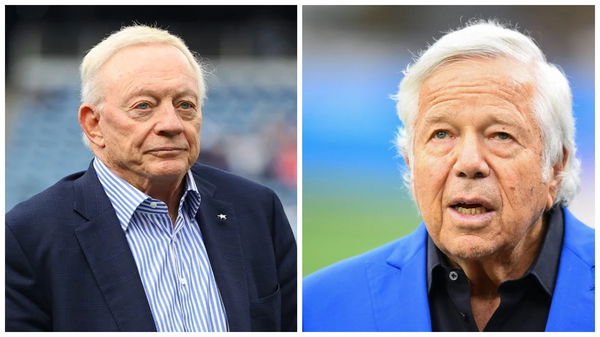

It is not just the big names like Robert Kraft and Jerry Jones, who are supposedly under the radar. According to this footage, the IRS might potentially be targeting all 32 franchise owners for not paying enough in taxes. Mena said, “So last week the IRS decided to go after the owners of the NFL teams.” As the undercover journalist enquired about the reasoning for doing so, Mena revealed a few more details.

“Because they are like billionaires and they pay very little taxes... If we find a mistake, we make them pay like 100 million dollars,” said the IRS criminal investigator. However, Mena also agreed that this amount would not hurt the billionaire NFL franchise owners much and said “That’s a drop in the bucket for them.”

ADVERTISEMENT

Article continues below this ad

In this leaked video of Alex Mena, who runs criminal investigations at the IRS, the IRS is targeting every #NFL owner for not paying enough in taxes (legal or not) … and that any mistake could result in a $100M fine, “a drop in the bucket for them.”

(🎥 @JamesOKeefeIII) pic.twitter.com/WnZRyVIQfm

— uSTADIUM (@uSTADIUM) February 23, 2024

For more context, a 2021 ProPublica report titled The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes.” pointed out that a “massive tax break allows [sports team owners] to report huge losses to the IRS, even if their teams are profitable.” For now, the exact details of such an operation by the IRS are not revealed to the public. But one thing is for sure, as Mena pointed out, this could cost the owners hundreds of millions of dollars.

READ MORE: Inside the Raiders’ New “Mahomes-Rules” Plan Which Deviates From Roger Goodell’s Vision for the NFL

If sports owners are taking losses that are allowable under the tax code, why is the IRS auditing them?

IRS targets sports industry losses: Scrutiny on high-wealth owners’ tax breaks

The IRS is taking a swing at sports industry losses as a way to make sure that these incredibly high-wealth owners are taking only those losses allowable under the law. Reporting huge losses for a profitable business doesn’t mean that an IRS audit will result in additional tax due. This is because the professional owners who take the losses know the Internal Revenue Code allows it.

The IRS Large Business and International division recently announced a campaign. The plans were to look into whether the income and deductions of sports-related partnerships with large losses are reported in compliance with the tax code. Sports-related partnerships are arrangements that fit well with the IRS’s enforcement push.

Nick Passini, partner and tax advisor of RSM US LLP, said, “Who generally owns these sports partnerships? In most cases, it’s an ultra-high-net-worth individual… The IRS is really focusing on partnerships that kick off losses. Sports partnerships, because of the amortization benefits and other things, often do kick off losses.”

Sports owners have long claimed considerable losses to the IRS despite having profitable teams as a way to get massive tax breaks, which the Internal Revenue Code permits. While the breaks are allowed under the code, the IRS likely wants to make sure no owner is claiming losses that aren’t allowed.

Sheri Dillon, a tax partner at Morgan Lewis, advised sports owners and said, “Because the best defense is a good offense, sports industry partnerships and their owners should start their preparation now… At bottom, any IRS adjustments initially result in a partnership-level tax, which is often not the same as the correct tax. The onus is on the sports partnerships and their owners to use the new procedures to get to the correct tax liability.”

ADVERTISEMENT

Article continues below this ad

As the IRS gears up to put the $25 billion in increased enforcement budget to good use, this is just one of the many new campaigns we can expect to see for high-income / high-wealth taxpayers. However, the NFL owners will be under pressure to not pay any fines. Only time will tell what this criminal investigation is going to unearth for the franchise owners. Or if they stay the course after the recording has been leaked.

ADVERTISEMENT

Article continues below this ad

What are your thoughts on this ordeal regarding the taxation of the NFL owners? Let us know your opinions in the comments.

READ MORE: Derrick Henry Parents: Know More About Dad Who Was Imprisoned Nearly 20 Times, & Mom Stacy Veal

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT