USA Today via Reuters

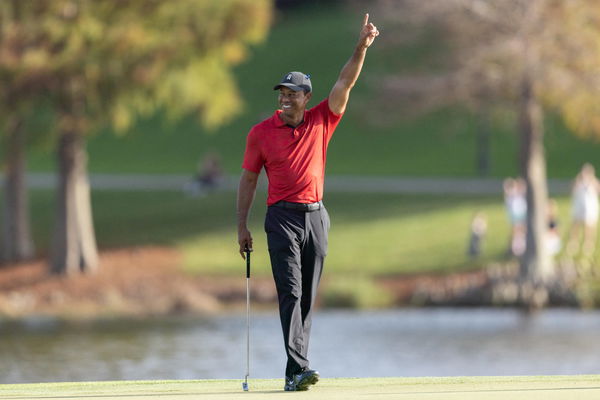

Dec 19, 2021; Orlando, Florida, USA; Tiger Woods looking at his ball on the 14th hole during the final round of the PNC Championship golf tournament at Grande Lakes Orlando Course. Mandatory Credit: Jeremy Reper-USA TODAY Sports/Reuters

USA Today via Reuters

Dec 19, 2021; Orlando, Florida, USA; Tiger Woods looking at his ball on the 14th hole during the final round of the PNC Championship golf tournament at Grande Lakes Orlando Course. Mandatory Credit: Jeremy Reper-USA TODAY Sports/Reuters

When somebody hears the name Tiger Woods, they think of golf. After all, he is the greatest of all time. But, once you get to know more about the legend, you will understand that he is a businessman as much as a golfer.

Watch What’s Trending Now!

TGR is the name of Tiger’s enterprise, where he manages all of his businesses and philanthropic activities.

ADVERTISEMENT

Woods founded TGR Foundation in 1996 to help the students who had limited access to educational resources. He also created TGR Designs in 2006 to build golf courses; TGR Live, The Woods, etc. are some of the other ventures.

ADVERTISEMENT

Watch This Story: Reports Provide Disappointing Update on Tiger Woods Return

Like his other ventures, Tiger was fast enough to invest in the rising SPACs. And now, the SPAC, where Woods has the major share, has filed in an IPO.

ADVERTISEMENT

The blank-check company of Tiger Woods is raising a massive amount!

USA Today via Reuters

Dec 19, 2021; Orlando, Florida, USA; Tiger Woods reacting to Cameron Kuchar draining a long putt on the 17th green during the final round of the PNC Championship golf tournament at Grande Lakes Orlando Course. Mandatory Credit: Jeremy Reper-USA TODAY Sports/Reuters

As a sports entity, the SPAC of Tiger is a Sports and Health Tech Acquisition Corp. The company recently filed in an IPO to raise $150 million.

ADVERTISEMENT

The SPAC of Woods’ said that they are planning to merge with a company in the sports or health technology category. They didn’t mention the name of the company. However, they revealed that the target company has an enterprise value of $600 million to $1 billion.

Top Stories

Novak Djokovic Makes a Bold Coaching Move As He Looks the Challenge Carlos Alcaraz & Jannik Sinner in 2026

Russian Tennis Hit Hard as Another WTA Player Forfeits Citizenship

Aryna Sabalenka Breaks Silence on Nationality Switch After Belarus Representation Ban

Carlos Alcaraz and Jannik Sinner Take Bizarre On-Court Decision as Australian Open Countdown Begins

Novak Djokovic Confirms Adelaide Return as Carlos Alcaraz and Jannik Sinner Set for Exhibition

ADVERTISEMENT

A talented group of people manages the Woods SPAC. The Chairman of LeAD Sports ltd. Andrew White, a managing partner of Excel Sports Management, Mark Steinberg, the chief financial officer of Tiger Woods Ventures, Christopher Hubman, are all part of the management team.

ADVERTISEMENT

Furthermore, Tennis star Caroline Wozniacki and retired NBA player David Lee are among the executives in this new project. The trio brings a powerful portfolio with them and while Woods is the lead investor, the Woods-Wozniacki relationship is crucial for the project’s success, as per a document:

“Their relationships and experience produce proprietary deal flow that, when paired with leAD’s rich industry experience and subject-matter expertise as well as its own corporate network, will allow the company to be competitively positioned to source and select a value-generating target opportunity, and generate value post combination,” the document states.

ADVERTISEMENT

What is SPAC, and how does it work?

ADVERTISEMENT

A Special Purpose Acquisition Company or SPAC is a venture where investors invest money to create a fund to acquire or merge with a private company. An established and well-known group of people usually manages the SPAC.

Read more: The Meaning Behind the WAAC Clothing Line Logo That Kevin Na Famously Wears

The negative side of the SPAC is that the investors wouldn’t know which company they are targeting to acquire or merge with. That is why a SPAC is also called a blank-check entity.

The blank-check companies rose to prominence after the Covid-19 pandemic hit the world. Since it is a new concept, not many people tend to make one. However, the businessman Tiger Woods was quick enough to learn about it and has already filed in an IPO to raise money.

What do you think of Tiger’s new venture? Let us know!

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT