Imago

Image Courtesy: IMAGO

Imago

Image Courtesy: IMAGO

In the ever-evolving landscape of professional golf, the latest twist in the tale involves the PGA Tour’s apparent decision to distance itself from the ambitious venture known as LIV Golf. The LIV Golf League is backed by the deep pockets of the Saudi-based PIF, which has been making headlines since its announcement.

Watch What’s Trending Now!

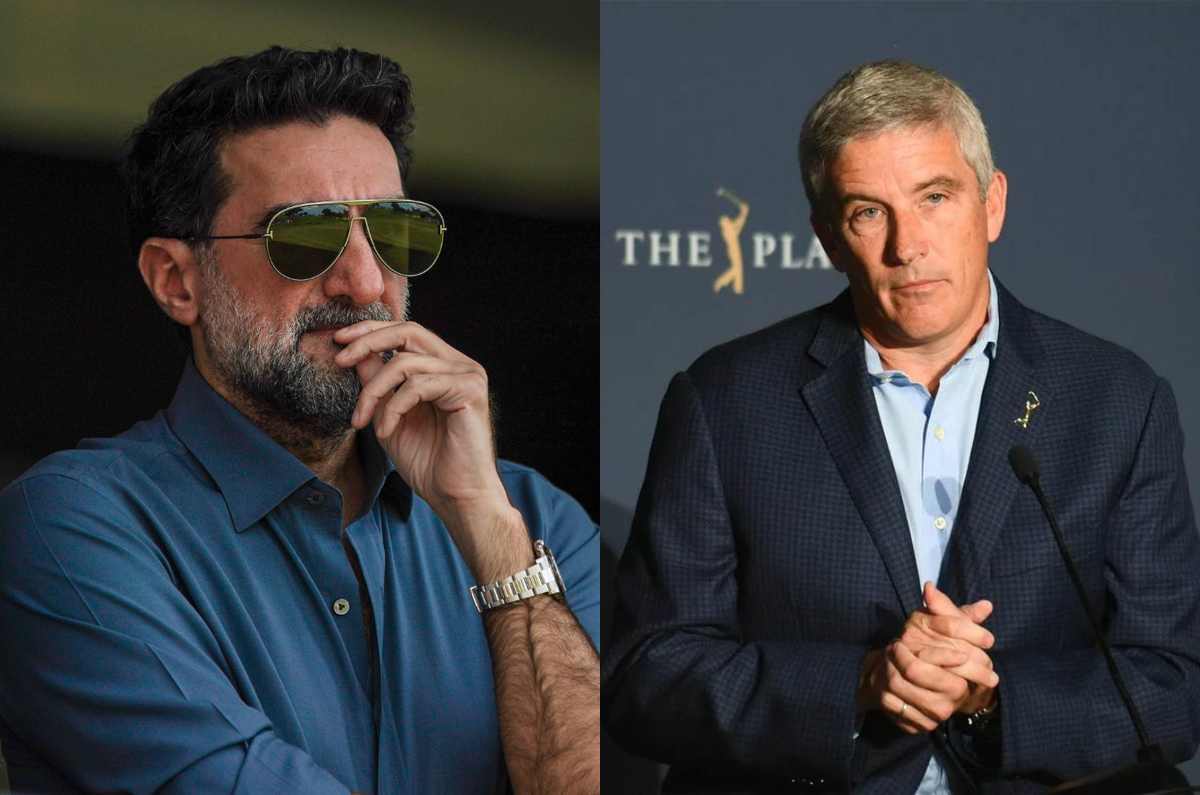

As the world eagerly awaits the launch of Tiger Woods and Rory McIlroy’s brainchild, TGL Golf, there are questions arising about LIV Golf’s viability and potential competition from global giants to Yasir Al-Rumayyan, the driving force behind LIV Golf and the Saudi Arabian Public Investment Fund (PIF).

Top Stories

Brooks Koepka Takes up New Role Amid LIV Golf Exit Rumors Reaching Boiling Point

Charley Hull Opens Up on Traumatic Divorce from Ex-Husband for the First Time Ever

LIV Golf to Cut Ties With Veteran Pro After His PGA Tour Return Intentions Became Public

What Happened to Golf Creator Brad Dalke’s Wife? Health Update Revealed

Congratulations Flood in from Lydia Ko & More as LPGA Star Makes Personal Announcement

ADVERTISEMENT

Global giants that pose a threat to Yasir Al-Rumayyan’s master plan

There are various global giants that are posing a threat to the $3 billion-dollar master plan of Yasir Al-Rumayyan. As the PGA Tour has pivoted away from LIV Golf, several others have shown interest in stepping into the place of the Saudi Backed Golf League.

The top contender for its spot is FSG, or Fenway Sports Group, which is associated with the prominent Liverpool Football Club. The group is one of the frontrunners when it comes to owning prominent sports franchises. FSG’s entry into the golfing world could pose a formidable challenge for LIV.

Eldridge Industries is another name on the list. With their ownership of the Los Angeles Dodgers and involvement in the acquisition of Chelsea Football Club, the company could bring a wealth of experience in major sports ventures to the golfing world should they choose to step into this world.

ADVERTISEMENT

Looks like the 5 PE entities (in addition to PIF) bidding to invest in ☂️:

– Fenway Sports Group + Steven Cohen & Arthur Blank;

– Liberty Strategic Capital;

– Acorn Growth Companies;

– Eldridge Industries;

– Group of influential individuals being called the “Friends of Golf.” 🙄 https://t.co/WK2x9DGNth— Pro Golf Critic (@ProGolfCritic) November 5, 2023

Liberty Strategic Capital, which is led by US Treasury Secretary Stephen München, is also in the race and has all the needed financial clout and influence to make the needed impact on the golf landscape. The connection with former POTUS Donald Trump could also be advantageous in hooking up with key players in the golfing arena.

ADVERTISEMENT

Acorn Growth Companies is diversifying out of the defense, intelligence, and aerospace industries. They might wish to bring a unique perspective to golf. The company would counter the foreign influence well since their focus will be U.S.-centric and could resonate well with American audiences.

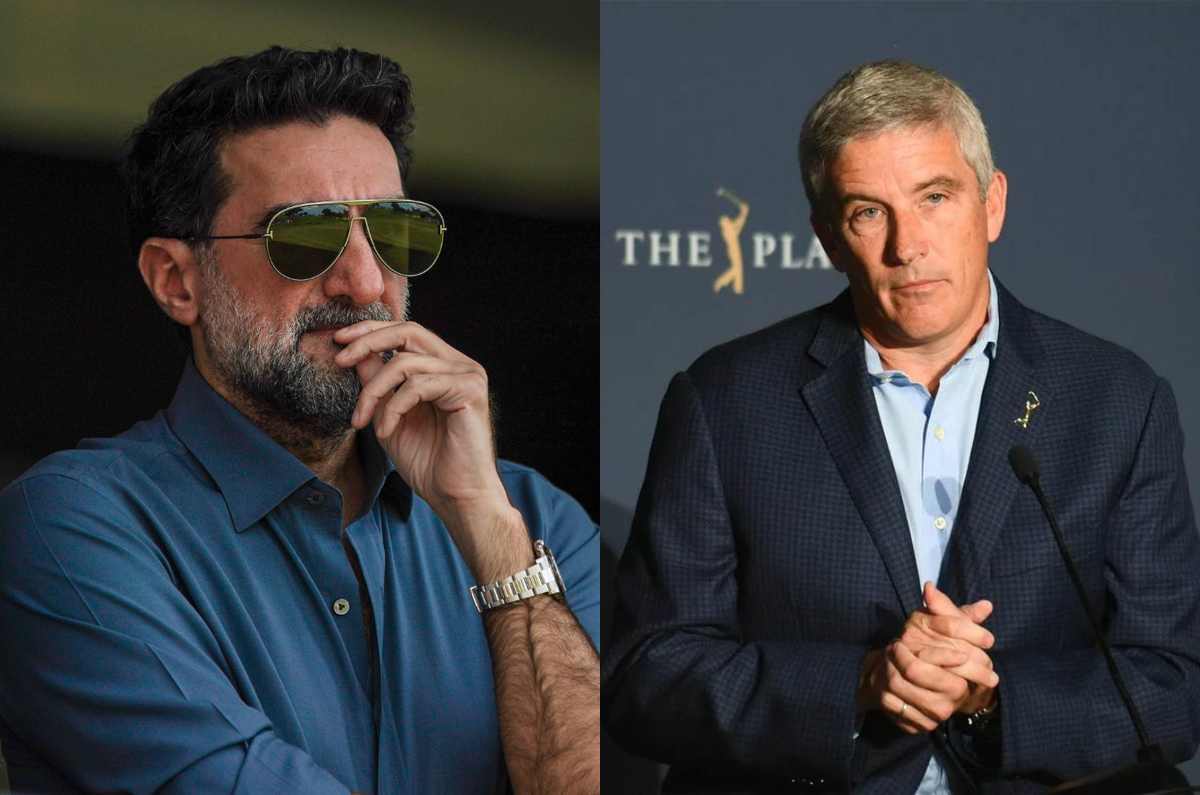

Amid the troubles of the merger between LIV and the PGAT, Jay Monahan certainly has the above to look for as alternatives. And maybe one just may come through!

ADVERTISEMENT

PGA Tour-LIV Golf Merger Controversy: U.S. Congress Seeks Clarity Amid Saudi Fund’s Expanding Influence

The proposed merger between the PGA Tour and LIV Golf remains mired in uncertainty, with U.S. Congress Senators demanding clarity on the controversial deal. The Saudi Public Investment Fund’s expanding influence in the U.S. has raised concerns, with allegations of exploiting investment platforms.

Senators emphasize the need for thorough committee approval, as PIF money could significantly impact the league. Yasir Al-Rumayyan’s absence during Senate hearings and his bold demands have added to the controversy. The fate of this $3 billion merger hangs in the balance, and the golfing world awaits further developments.

ADVERTISEMENT

Watch This Story | Weeks after Greg Norman’s LIV ladies series comment LGPA Commissioner clears the air on rumors that were really bullish

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT